1. Why Pre-Rolls Are Suddenly Everywhere

Walk into any music festival, hostel common room, or hip café in 2025 and you will spot the same ritual: a neatly packed cone pulled from a hard-shell tube, sparked in seconds. Convenience, cleaner paper, and a no-mess experience have turned pre-rolled cones from niche import to mainstream staple.

Recent research puts the global pre-rolled cone market at US $297 million in 2023, racing toward US $1.1 billion by 2029 at nearly 25 percent CAGR. India’s share is small but surging, helped by rising disposable income, e-commerce penetration, and a cultural shift toward premium accessories.

2. What Exactly Is a Pre-Rolled Cone?

A pre-rolled cone is a funnel-shaped rolling paper that has already been glued, rolled, and fitted with a filter tip. Consumers simply fill, tamp, and twist—no rolling skill required. The format demands manufacturing precision: paper weight (usually 12-14 gsm), adhesive line, seam tightness, and filter crimp must all be consistent or the cone can canoe, tear, or taste bitter. That technical barrier has created room for a new kind of business in India: the pre rolled cone manufacturer.

3. Market Forces Shaping Indian Production

|

Driver |

Evidence |

Outcome for Manufacturers |

|

Eco-friendly demand |

Rolling-paper market projected to reach US $2.1 billion by 2032 on the back of unbleached and hemp variants |

Need FSC-certified pulp, chlorine-free bleaching |

|

Convenience culture |

Urban consumers prefer ready-to-fill cones over hand-rolling |

Automated cone lines gain share |

|

D2C e-commerce |

Gen Z buys accessories online; shipping promises matter |

Local plants cut delivery time and duty costs |

|

Lifestyle branding |

Accessories are fashion statements |

Visual design and merch bundles drive margin |

4. Enter LITAF: From Passion Project to Production Powerhouse

LITAF began as a small shop selling imported rolling papers. Founders soon realized reliable supply was scarce and margins were thin, so in 2022 they invested in a semi-automated cone line on the outskirts of Jaipur. That decision turned LITAF into a home-grown pre rolled cone manufacturer able to hit three crucial benchmarks:

-

Quality: Food-grade gum, laser-sealed seams, and paper from FSC-certified European mills.

-

Cost: Local assembly keeps retail price under ₹6 per cone even after GST.

-

Speed: Two-day shipping to metros thanks to hubs in Mumbai and Bengaluru.

4.1 Manufacturing Workflow (Simplified)

-

Paper slitting into cone sheets (tolerance ±0.1 mm)

-

Cone rolling on semi-automatic mandrels

-

Filter crimping and insertion

-

Laser seal of paper seam

-

Batch testing for airflow and structural integrity

-

Vacuum-sealed packaging with 85 percent statutory health warning

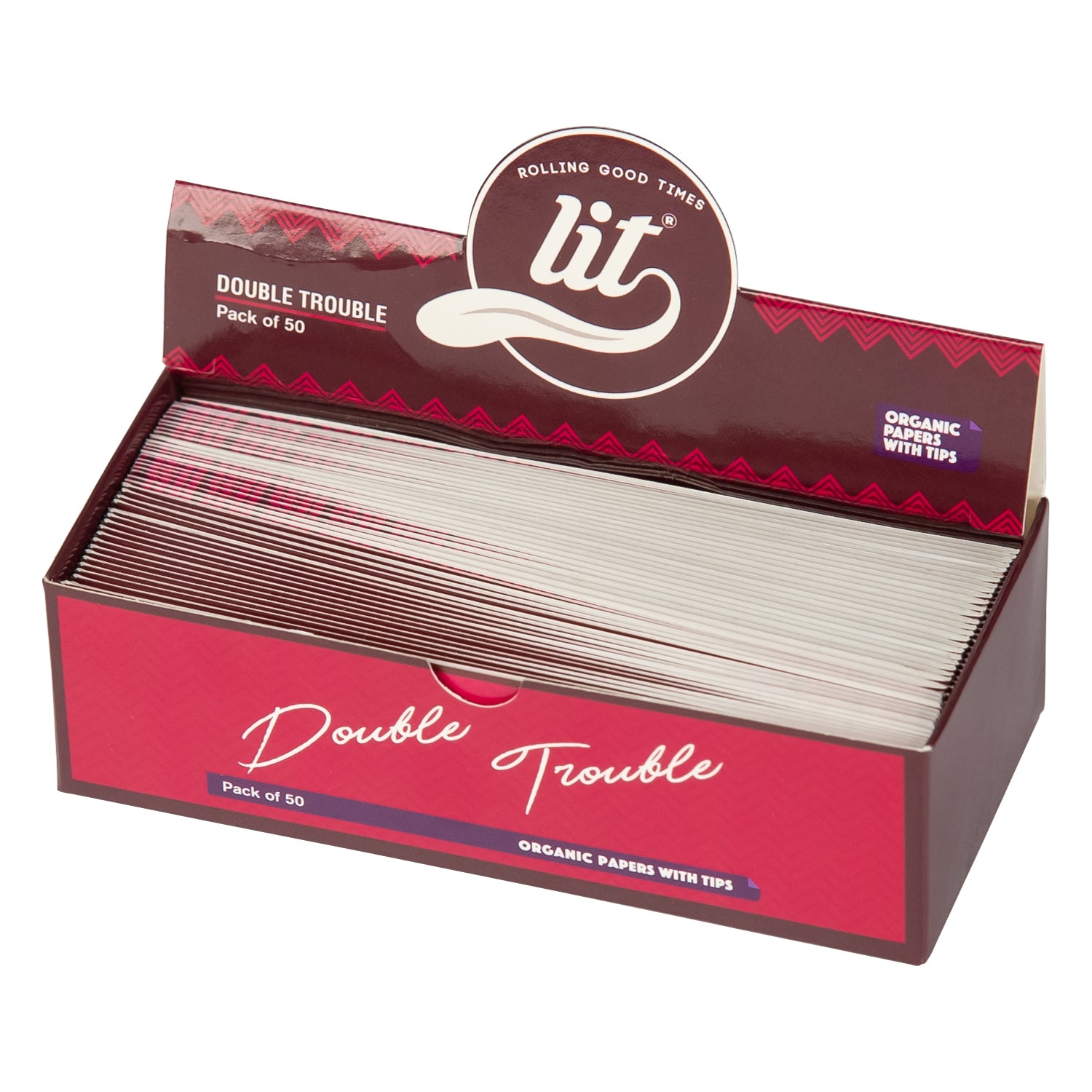

4.2 Brand Playbook

-

Design drops: Limited-edition artwork every quarter keeps collectors engaged.

-

LITFAM loyalty: Points for unboxing videos and referrals boost repeat rate (now 43 percent).

-

Educational content: “Rolling 101” reels show novices how to pack cones without waste, solving a real pain point and earning trust.

5. Regulatory Snapshot

All tobacco-based cones fall under the Cigarettes and Other Tobacco Products Act (COTPA). Herbal or hemp cones sit in a regulatory grey zone but still face strict packaging rules: 85 percent health-warning coverage, no lifestyle claims, no celebrity endorsements, and GST compliance. LITAF complies by keeping marketing focused on design, sustainability, and community—not on health or social status.

6. Competitive Landscape

|

Brand |

Strength |

Gap vs LITAF |

|

RAW (imported) |

Legacy reputation, ultra-thin paper |

Higher price after import duty; slower restock |

|

OCB |

Widely available booklets |

Limited pre-roll SKUs in India |

|

Local unbranded cones |

Low price |

Inconsistent paper weight and gum line |

|

Boutique D2C labels |

Niche flavors |

Small batch size, stock-outs |

By controlling its own line and emphasizing lifestyle design, LITAF occupies a sweet spot between reliability and cultural relevance.

7. Future Outlook for Indian Producers

-

Automation upgrades: Fully automated cone lines could cut per-unit cost another 18 percent.

-

Sustainability pressure: Expect GST incentives for biodegradable filters and recyclable packs.

Cross-category play: Pre-roll brands will increasingly launch apparel, NFTs, and music collabs to extend lifetime value.